how to lower property taxes in california

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. This video covers how property tax is calculated and how you can pay a lower overall property tax.

Understanding California S Property Taxes

Bonsai Tax can help.

. This means if a parent bought a property in the 1970s and has a tax basis that is. How can I lower my property taxes in California. Applicants must file claims annually with the state.

Here are a few steps you can take to cut your property taxes. If Bonnie and Clyde. Steps to Appeal Your California Property Tax Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county.

If the tax rate is 1 they will owe 9000 in property tax. When you see an error in official records we can help expedite the process of lowering your property taxes. Look for local and state exemptions and if all else fails file a tax appeal to lower your property.

Up to 25 cash back The San Francisco County Assessor placed a taxable value of 900000 on their home. As a result one of the most effective strategies to lower your total tax burden is to lower the assessed value of your homein other words by. It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level.

Ask the tax man what steps you need to take in order to appeal your current bill. Our software will scan your bankcredit card receipts. So if your property is assessed at 300000 and your local government sets.

If you are self-employed a sure-fire way to pay less taxes in California is to reduce your business expenses. Property 8 days ago The property tax rate in California is 075 which is lower than the nations average rate of 107. To reduce your property taxes in a few clicks do the following.

Access your DoNotPay account Open our Property Tax feature Provide the necessary answers Follow the instructions from our. Learn About the Property Tax Relief in California Pro. Assessed value is often.

If a homeowner feels that there was an incorrect valuation of their home they may be able to reduce their California property. Mailed payments must be postmarked no later than April 10 2023. Please note there is a convenience fee of 25.

ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952 Office Hours 8 am. By the time you are already paying a certain amount its. There are a myriad of others.

Contact your local tax office. How Do I Reduce My Property Taxes. How can I lower my property taxes in California.

Electronic Payments can be made online or by telephone 866 506-8035. The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner. One of the most effective ways to acquire property ownership in California is through adverse possession which is the result of low property tax rates.

The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California. Decline in Property Value Proposition 8 Since property taxes. In comparison to the.

How Do State And Local Property Taxes Work Tax Policy Center

Understanding California S Property Taxes

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

At What Age Do You Stop Paying Property Tax In California Best Tax Service

California Property Tax Calculator Smartasset

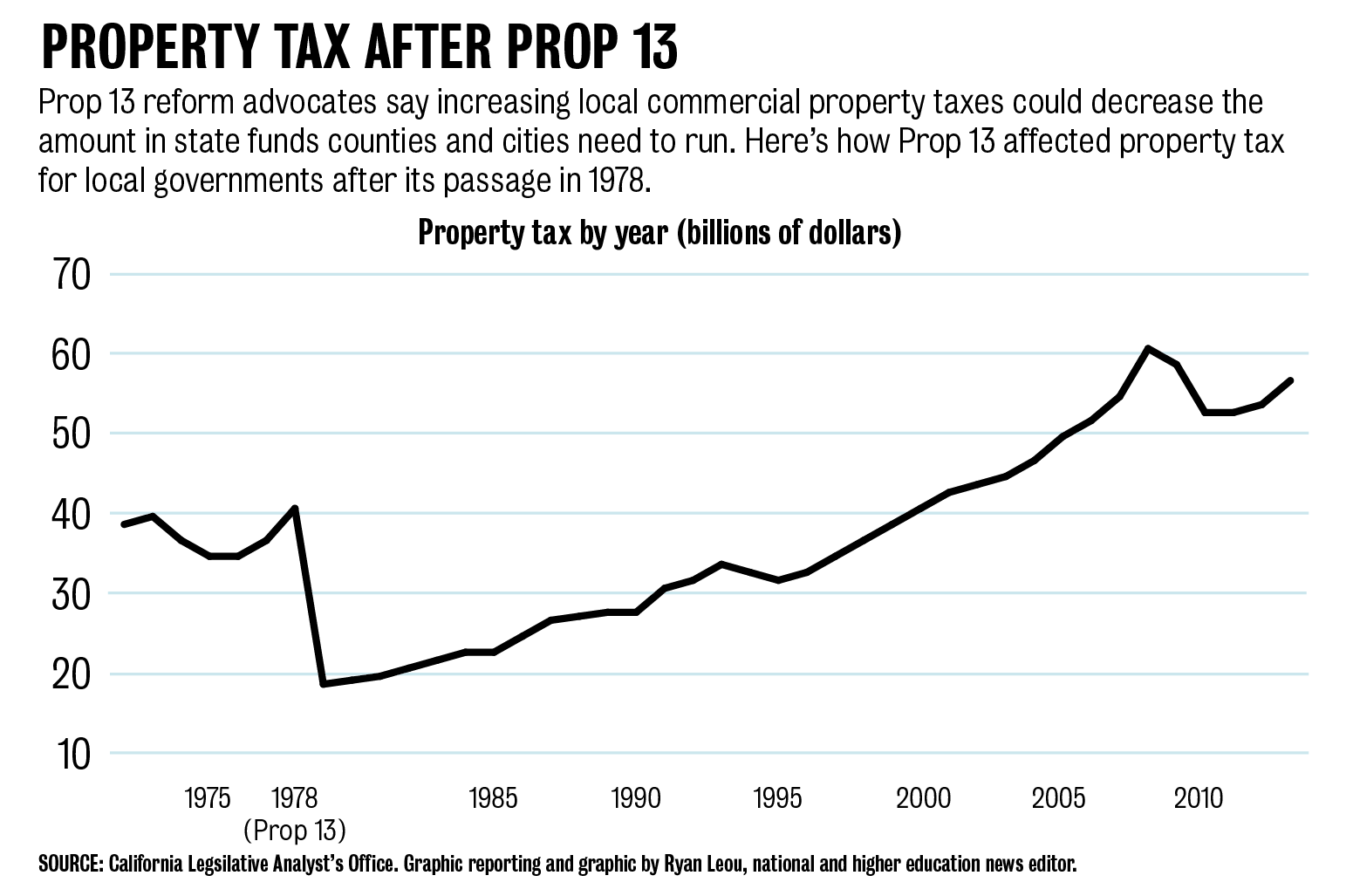

Ucsa Campaign Aims To Reform Prop 13 To Increase Uc Funding Daily Bruin

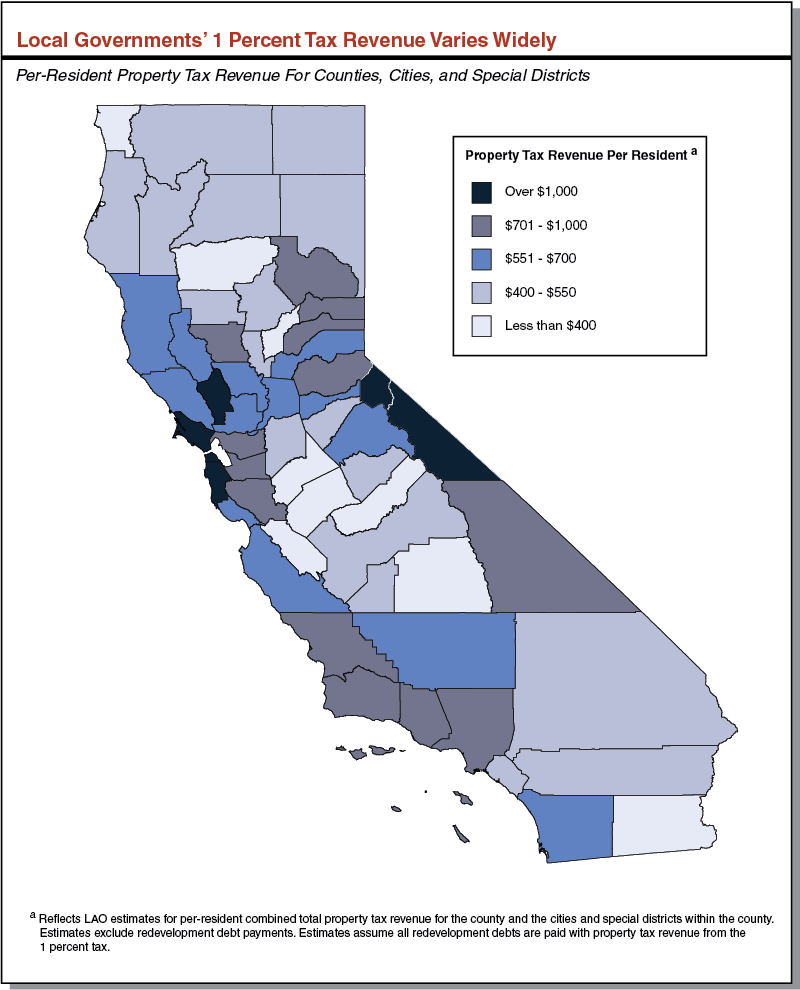

Differences In Property Tax Revenue For Counties Cities Special Districts Econtax Blog

Property Tax California H R Block

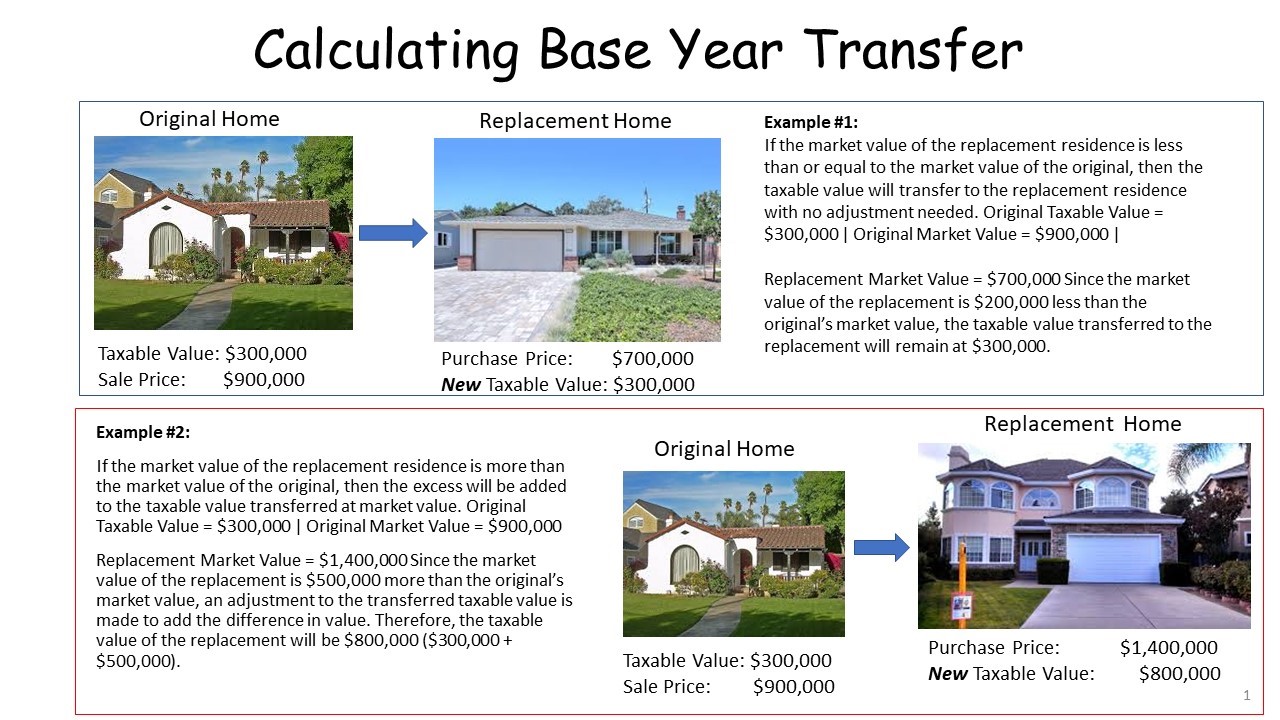

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Reduction Home Appraiser Services

A Breakdown Of 2022 Property Tax By State

California Property Tax Appeal How To Lower Property Taxes In California

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Understanding California S Property Taxes

Property Taxes Are Twice As High In Poor Neighborhoods As Rich Ones The Washington Post

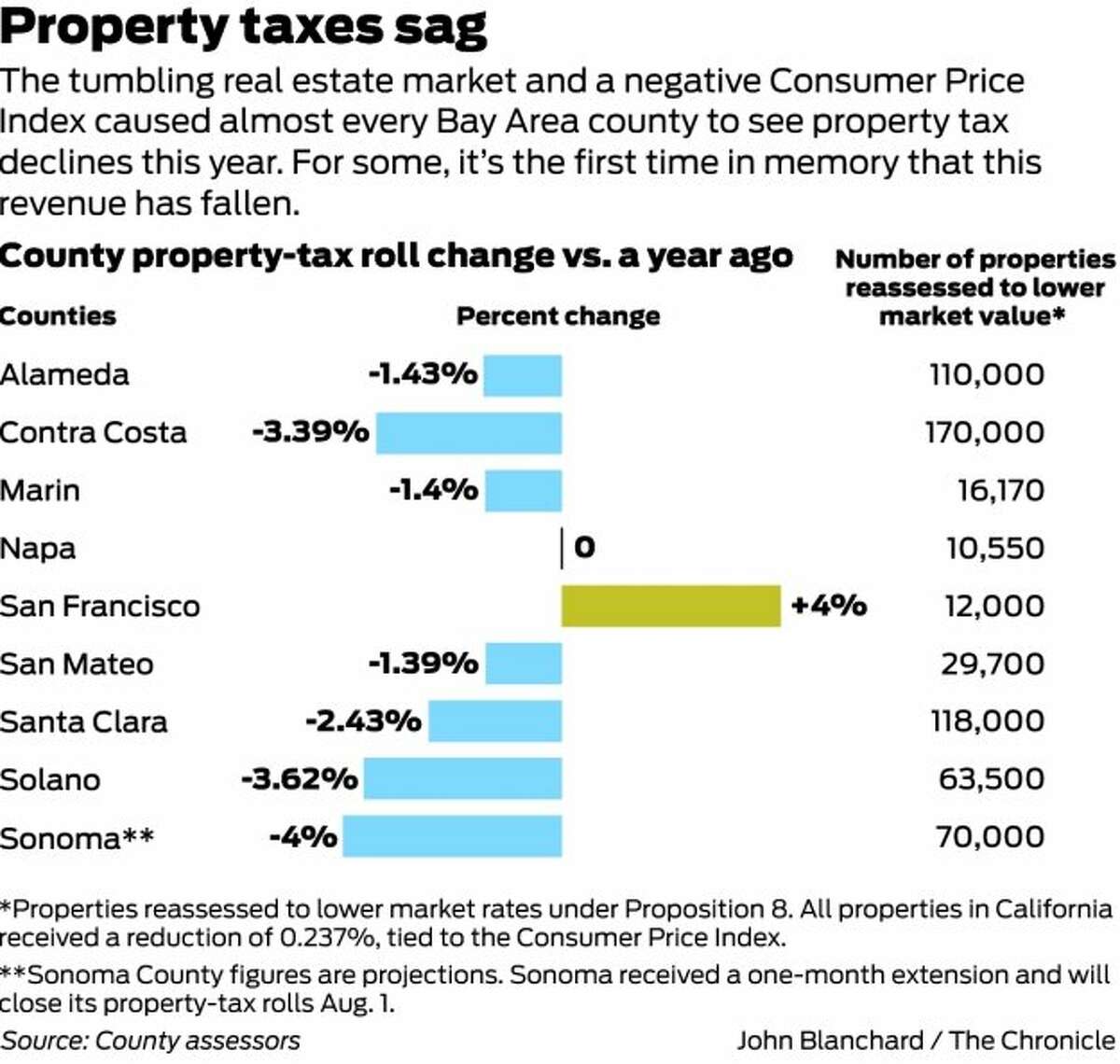

Record Declines In Bay Area Property Taxes

The Difference Between Market Value And Assessed Value In California